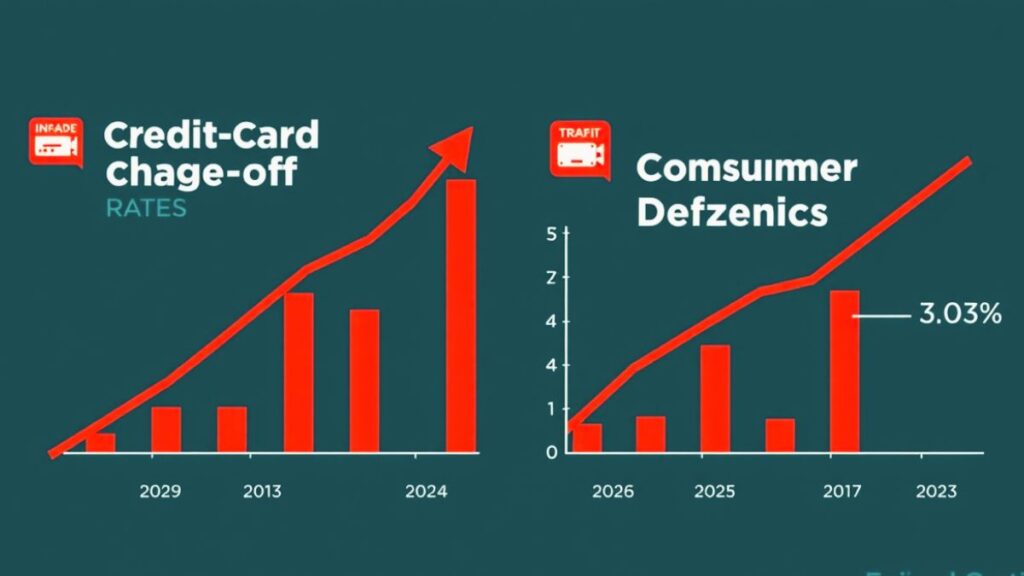

US Credit Card Defaults 2025 : In the primary sector of 2025, US credit score card defaults have reached alarming levels, signaling mounting monetary pressure among purchasers. According to Fitch Ratings, price-offs for prime credit score playing cards rose via 8% from the previous quarter, hitting 3.03%. This uptick is attributed to chronic inflation, expanded price lists, and delayed interest price cuts, which have collectively strained family budgets.

Economic Pressures Intensify

The US economy is grappling with more than one demanding situations. Fitch Ratings these days downgraded its US increase forecast for 2025 from 2.1% to one.7%, bringing up the effect of multiplied price lists and rising import fees. The powerful tariff rate has surged from 2.3% in 2024 to 8.5% in early 2025, with projections indicating it could attain 18% by using yr-end.

These tariffs have led to higher patron expenses, lowering actual wages and growing commercial enterprise prices. Consequently, the Federal Reserve is expected to postpone expected fee cuts, similarly exacerbating monetary pressures on customers.

Consumer Behaviour Shifts

As inflation erodes buying energy, customers are more and more counting on credit cards to manage expenses. Monthly fee charges (MPRs) for high credit playing cards remained regular at 41.34% in Q1 2025, barely above the 41.27% determined in Q4 2024. However, this balance may be quick-lived as hobby quotes continue to be excessive and savings dwindle.

Data from the Federal Reserve Bank of Philadelphia suggests a document excessive share of cardholders making best minimal bills in overdue 2024, a fashion that could lead to greater delinquencies and defaults.

Broader Financial Strain

The monetary pressure is not constrained to lower-income families. A growing number of wealthier and high debtors—those with credit score ratings between 660 and 719—are falling in the back of on their money owed. Delinquencies in car loans, credit score playing cards, and home equity lines of credit have risen sharply because the cease of 2024, signaling financial misery amongst previously solid borrowers.

This trend is regarding, as the wealthiest 10% are answerable for half of of consumer spending. Their reduced discretionary spending could heighten the risk of a recession.

Global Implications

The US monetary challenges have worldwide repercussions. Fitch Ratings has decreased its global boom forecast amid the continued trade warfare, with international increase anticipated to gradual to two.Three% in 2025, down from 2.Nine% in 2024.

Countries like Mexico and Canada, heavily reliant on change with the USA, are dealing with technical recessions. Meanwhile, Germany and China’s fiscal easing might also soften the blow, however the average outlook stays bleak.

Outlook for 2025

Despite the current demanding situations, Fitch Ratings notes that robust credit fundamentals amongst top borrowers and restrained account additions to applications are supporting counteract huge performance declines for the total yr 2025. However, the aggregate of increased price lists, rising import charges, and delayed fee cuts keeps to pose dangers.

As households increasingly more rely upon credit card borrowing to deal with the excessive price of residing and different money owed, credit card balances are projected to upward push in 2025. If hobby prices live high and financial savings keep to dwindle, credit score card utilization is likely to grow, probably leading to a slowdown in fee rates and in addition defaults.

Conclusion

The surge in US credit score card defaults in 2025 underscores the monetary strain confronted through consumers amid economic uncertainty. With inflation, tariffs, and not on time fee cuts contributing to the stress, each clients and policymakers need to navigate a challenging panorama to make certain economic stability.

Also Read – Japanese Life Insurers Expand in US 2025 – What It Means for American Policyholders